Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

What Is A Default?

When you take out a loan, mortgage, credit card or any other type of finance you are entering a credit agreement which sets out your monthly repayments and schedule for paying back the debt.

In the event of you missing a number of payments consistently as well as incurring possible late fee`s a default can be added to your credit file, damaging your credit profile.

In the event of you missing a number of payments consistently as well as incurring possible late fee`s a default can be added to your credit file, damaging your credit profile.Removing A Default From Your Credit File

When you get a default added to your credit profile then it will remain there for up to six years, but in most cases they will not have much impact for most lenders after around two to four years as long as you do not pick up any more defaults during this period. It can be especially helpful if you (b>settle the default asap. This means you get an agreement with the lender who you defaulted on to pay them an amount for them to agree the debt is no longer due. If this is done in one go it is usually known as a ``full and final settlement``, if you do this on the drip the debt will effectively be in an arrangement, this will still often show as a default and not satisfied until the arrangement concludes successfully.

Smaller defaults that are associated with mobile phone providers or catalogues / mail order are looked upon in a softer light by some (not all) lenders, albeit they may still affect the rate / amount you can borrow. If you have defaults listed in your credit file in the last two years this could affect any application you may be considering for finance.

In some cases you may find that you have had a default added by mistake or you may have paid the debt within the necessary time period you could have grounds to remove the default from your file.

The process for removing the default need to involve the lender who placed the default on your profile, you must write the lender including the details of the default and your account details, within the correspondence you must give details on why you believe the default should be removed.

If you have received a default and finding it difficult to meet your credit repayments then it is important that you take steps to resolve the problem, contact your lender and discuss the different options available and see how they can help.

One possible solution to consider is to restructure your debts, if you have multiple debts such as loans, credit cards and a mortgage you may be able to consolidate all your debts into your mortgage or via homeowner loan. Consolidating your debts may allow you to extend the term of the debts and reduce your monthly payments making them more affordable and to settle the defaults that are still live. The drawback of extending any finance term is you will be paying back more interest over the duration of the finance and if you secured the debts on your home the lender can ultimately take possession of your home if you default on the debt, the same as with any mortgage / remortgage.

I Can`t Remove The Defaults, Can I Still Arrange Finance

Here at First Choice Finance we understand that many of us may have blips on our credit file, through our lenders and intermediaries we may be able to enable you to obtain homeowner loans, mortgage deals and personal loans that accept people with defaults, our UK based team will talk about your finance needs and try to find a finance solution from our panel of lenders / intermediaries that best meets your individual needs and requirements. All mortgage and loan quotes are provided free of charge and we won’t carry out a credit check until we have discussed the options with you and found a plan that you are happy with. When you are ready to see what we can do give us a call on 0800 298 3000 (free phone) / 0333 003 1505 (mobile friendly) or complete our online form at the top of this page and we will come back to you.

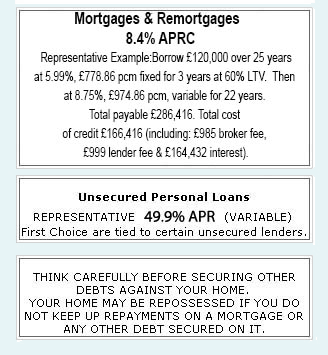

Mortgages & Remortgages |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential